Deep value investing is a powerful way to beat the market, but deep value stocks are an endangered species in the U.S.

I was recently talking with Tobias Carlisle, author of Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations, about what constitutes a deep value stock. To find these stocks, Tobias prefers to use the “takeover” multiple. One version of the takeover multiple is the ratio of EBITDA (earnings before interest, taxes, depreciation and amortization) to enterprise value (market value of equity plus book value of debt minus cash).

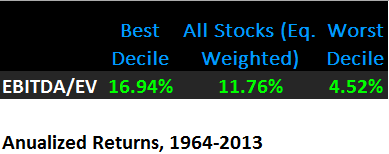

This is a great multiple for stock selection. Like the price-to-earnings ratio, it helps you find unloved companies, but it also penalizes stocks for having too much debt (more debt = worse ratio, ceteris paribus). If all you did was buy the 10% of stocks with the cheapest EBITDA/EV ratios on an annual basis, you’d have outperformed the market by more than 5% annually over the past five decades.

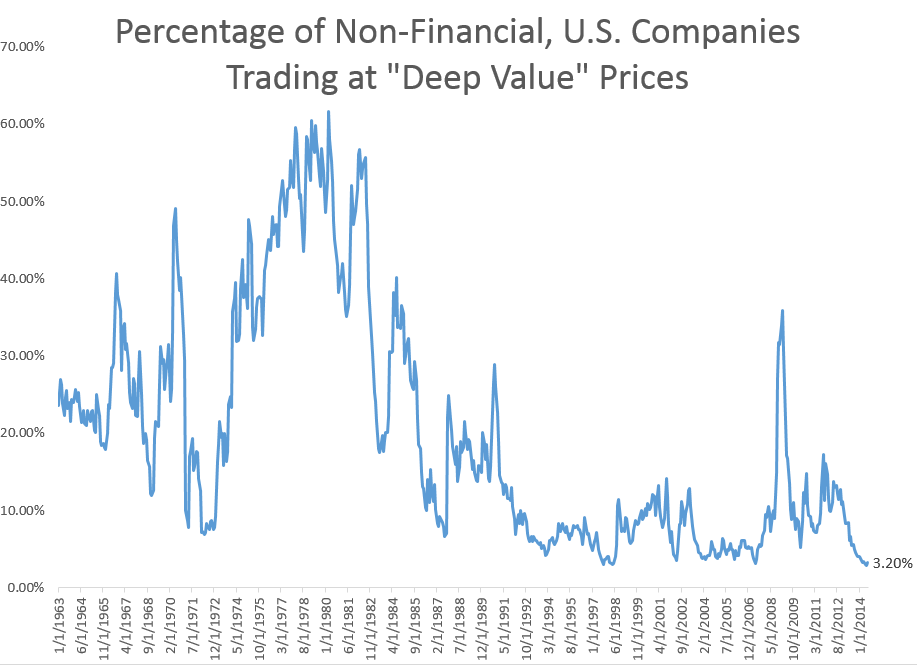

I asked Tobias what he considers a very cheap multiple EV/EBITDA multiple, and we agreed that somewhere below 5x indicates a cheap stock, while a multiple of less than 3x indicates very deep value. So here is the problem: today, we face what is perhaps the most difficult environment for deep value investing in history. Just 3.2% of non-financial, U.S. companies with a market cap of at least $200MM trade at an EV/EBITDA multiple below 5x. That is just off June’s all-time low of 2.9%.

There are just 65 stocks today with deep value multiples. Most are small. While a few big energy stocks make the cut (COP, HES, MRO), the median market cap of these 65 stocks is just $1B. If we limit ourselves to EV/EBITDA multiples below 3x, then I see just 7 stocks available. The largest has a market cap less than $2B.

So what is a deep value investor to do? Two options are to go smaller (into the micro-cap market) and go international. I’ll explore these options in a future post. Going smaller isn’t feasible for big institutional asset managers, but is possible for the little guy. Going international is great, but hard to execute as a small individual investor.

As I’ve written before, this bull market has left us with a very homogenous market where valuations are clustered around the mean. The sad fact is that in 2014, it’s hard out there for a deep value investor.

For much more on the topic, go read Tobias’s book. You’ll notice that the book is expensive, but trust me—it is worth every penny.

/rating_off.png)

Thank you for your insightful posts. What is your source of information to identify US and international stocks <3x EV/EBITDA?

Not sure where the author got data from, but you can find this metric on Yahoo Finance under the "Key Statistics" page.

The very low multiples of the 70s are related to very high inflation and very high cash returns, and high expectations of future cash rates. A better way to view this graph would be to compare the ev/ebitda to the cash rate of the time.

Hello Patrick,

I woul like to know, have you ever read about any backtest on this EV/EBITDA ratio? Something like the return you would get by investing on the 10% lowest EV/EBITDA or even investing on EV/EBITDA lower than 5 (or any other number).

Thank you

There are always pockets of value, but general low market valuations only happen occasionally. I’m finding plenty of smaller companies in the US that offer great value, some at just a few times earnings. Abroad there are even more, right now there are 800+ companies at EV/EBITDA < 3 and less than 70% of book.

For cheap stocks look at France, look at Japan, look at Australia. In Australia alone 600+ stocks are selling for less than 80% of BV.

The ‘there are no ideas’ refrain is a bit tired at this point. In hindsight we were spoiled in 2009 and 2010 with so many values. My view is the current market is really no different than most times in the past in terms of difficulty in finding ideas. With a little work investors can be rewarded.