Profit margins have been steadily rising for huge companies, but margins have been stagnant or falling for smaller companies. Clearly, the large are getting richer. But viewed a slightly different way we see an even more exaggerated trend: the rich are getting richer.

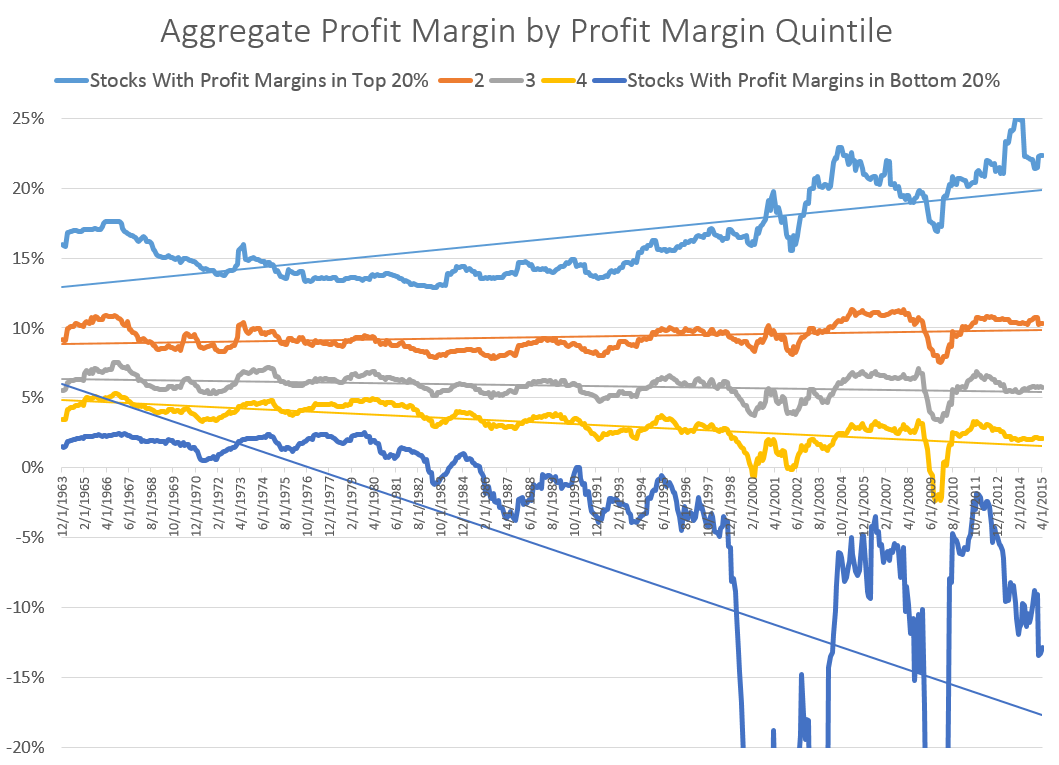

Forget market cap for a moment. Instead of sorting stocks on their size and then calculating their aggregate profit margins, below we sort stocks based on their current margin and then calculate their aggregate margin (total earnings divided by total sales). This tells us what the current margins are for companies that have the highest margins to begin with. The trend is clear:

This is a fun way of visualizing the trend.

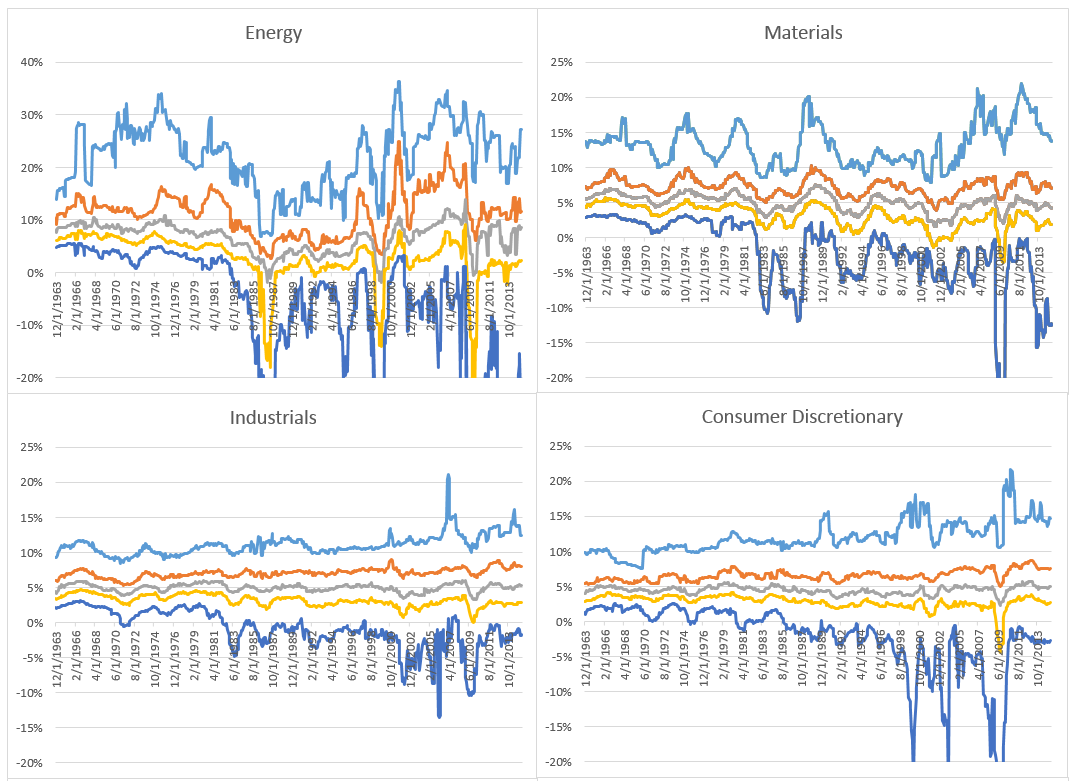

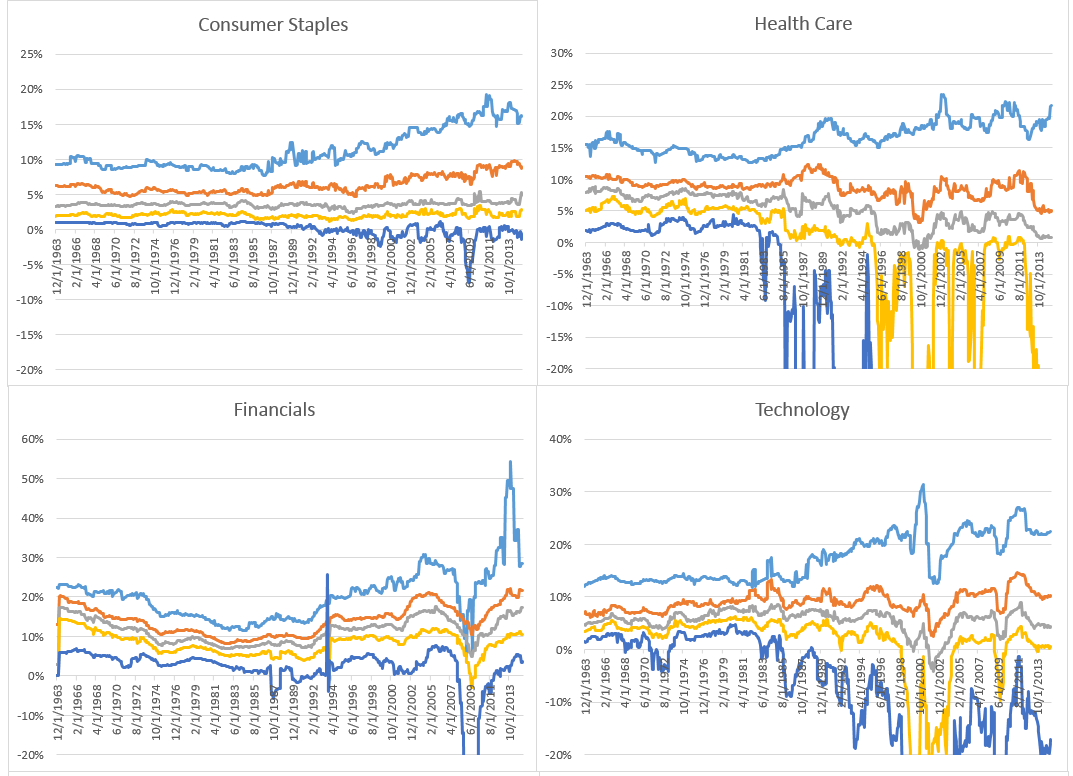

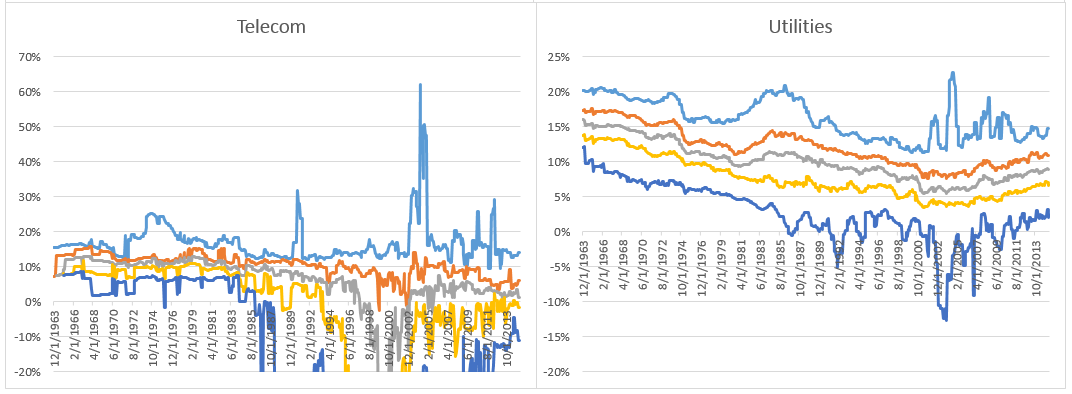

The margins of high margin businesses are expanding. The margins for low margin businesses are falling. The same holds true across most sectors, especially in consumer staples, technology, and financials, and health care.

The margins of high margin businesses are expanding. The margins for low margin businesses are falling. The same holds true across most sectors, especially in consumer staples, technology, and financials, and health care.

We know that the markets overall margin is much more driven by high margin technology and financial firms today than it was several decades ago. Will these trends continue? Will the rich keep getting richer? Let me know what you think in the comments section below.

Note: this includes all U.S. stocks with market caps> $200MM inflation adjusted through time.

/rating_on.png)

/rating_off.png)

Thanks for this analysis. We all now say “Of course, the profitable companies (sectors) continue to operate to increase profits until Mr. Market starts taking the profits away” OI wonder if you have any thouhghts on likely emerging profit-gaining sectors? Thanks

Any chance of you sharing the list of companies in this universe, along with sector, overall-quintile and sector-quintile?

It’s clear. But…

assuming this trend sustains itself and the riches will continue to get richer:

is profit margin alone a major driver of equities return?

In other words:

should profit margin be a relevant metric in stocks selection?

and in sector overweight for the long run?